What if you have started investing 10 years ago?

All it takes is ONE great opportunity to make it to the top

The key to spotting such stocks is by learning how to finding undervalued stocks. Imagine if you find not just one, but 3 or 5 such opportunities.

More than 70%

of retail investors lose money because

"I heard this stock is going to go up, so I decided to buy it."

"I watched a video on YouTube about this stock, and the person seemed really knowledgeable."

"I saw the stock price going up and thought it was a good time to buy in."

“I have good feelings about this stock.”

Newbies should

know that the world

of investing is BRUTAL

You are competing against:

-

Hedge Funds

-

Institutional investors

-

Company insiders

-

High-frequency traders

What will you learn when you join the intelligent investing academy?

Market Essentials

Imagine you’re playing a game, but you don’t know the rules or how to play it well.

It would be hard for you to win, right? Well, the stock market is like a big game where people buy and sell pieces of companies. If you want to do well and make smart decisions, you need to learn the basics first.

we will learn:

- Fundamentals of the stock market.

- How & Why Companies issue shares.

- Learning the steps to purchase and sell your initial stock.

- Why the stock market exists.

When you master the fundamentals, you’ll have a better chance of making good choices and growing your money in the stock market.

join 3,536 like minded people

join 3,536 like minded people

Market Mechanics

89% of beginners loose money because they don’t know how large players manipulate stock prices.

Huge investors such as Blackrock that have trillions of dollars under control have the ability to move the market.

The market can instantly rise and then suddenly plummet with no logical explanation.

The only way to understand what’s happening in the market is to master the ins and outs of the stock market. Even professional investors struggle to accurately predict the market, what do you think happens to those who don’t know how the market works.

- Primary factors that drive stock prices.

- Nasty strategies companies use to manipulate their stock prices.

- Who determines the price of the stock.

- How federal reserve’s actions influences the market.

- Why the stock is traded in the market does not necessarily reflect its true intrinsic value.

Once you complete this module, you will be able to identify the overall direction of the market.

Financial Statements

You cannot find the true of any stock if you don’t know how to read financial statements and 99% of newbies don’t even know where to find them.

Behind every stock, there is a real company with real products and services. The price of the stock is just a reflection of company’s performance. The stronger they are, the more likely the stock will rise.

- The statement of financial position.

- The statement of comprehensive income.

- The statement of cashflow.

By reading the financial statements of the company before investing, you will already have a competitive advantage over 90% of retail investors.

Your job is to find out the true financial health

of the company by analysing its financial statements.

join 3,536 like minded people

join 3,536 like minded people

Quantitative Analysis

Let’s be clear: an intelligent investing decision is buying undervalued stocks!

But to find undervalued stocks, you have to find

the real value of the company first and then compare it to the price that its traded in the market.

- Evaluate company’s financial leverage.

- Find out how liquid the company is.

- Assess the company’s capacity to sustain operations.

- What is the fastest way to find undervalued stocks.

- Evaluate company’s operational efficiency.

When you learn how to do quantitive analysis,

you will no longer look at stock prices, you will first find out the real value of the stock, then compare it to the price that’s traded in the market and find out if its undervalued or overvalued.

Psychology

Of the Market

It doesn’t matter how smart

are you, you will get emotional!

The stock market isn’t just about numbers and charts. It’s also about emotions and how they can affect people’s choices. When you put your money on the line: fear, greed, and panic often drive your decisions.

That’s why even professional investors end up loosing.

- Why professional investors ignore market volatility.

- How to deal with market crushes.

- How to deal with losses.

- Why time in the market always beats timing the market.

Mastering the psychology of the stock market will help you make rational decisions based on market trends and analysis while stay disciplined, maintain a long-term perspective, and effectively navigate market fluctuations.

join 3,536 like minded people

join 3,536 like minded people

Existing Strategy

The secret to being a successful investor is knowing when to sell your investments. When you master the exiting strategy, it means you are really good at making sure you earn the most money and don’t lose too much. Timing the market can be tricky.

Sometimes there are just a few days when the market goes really high, and if you sell your investments at the very top, you can make a lot of money. But if you sell even just a few days earlier, you might miss out on that opportunity.

- When you should never sell your stocks.

- The 4 reasons why pro investors always sell.

- How to build an existing strategy.

- When to sell your stocks to reduce your tax bill.

Having an existing strategy provides a clear roadmap for decision-making and helps mitigate impulsive actions that can lead to poor investment outcomes.

Crafting Your Investment Strategy

Warren Buffett is the greatest investor of all time, but did

you know that he missed the opportunity to invest in Google, Amazon or Microsoft.

That’s because they key to successful investing is staying true to your investing strategy.

Just like in a game, you need to know what moves to make to win. A strategy helps you make smart decisions about when to buy and sell stocks, which companies to invest in, and how much money to put in.

- Maximize your returns by identifying opportunities.

- Avoid making impulsive decisions.

- Minimizes your risks.

- Stay focused on your long-term goals.

We will analyze your investing goals and craft and strategy that fits your strength and weaknesses.

A strategy that works for you.

join 3,536 like minded people

What do I get access to?

Lectures

Every lecture takes a difficult concept and breaks it down to explain it in a fun and interesting way, using pictures, stories, and examples. It’s like going on an exciting adventure of learning!

- Explore one major topic with multiple subtopics.

- Analyze real life practical examples.

- Answer most popular questions.

- Help students visualize the concepts that being.

Assignments

Learn through practice. Just like when you practice playing a sport, doing your assignments will help you get better at what you’re learning. When you complete your assignments, you understand the lessons better, and it prepares you to invest in the real world.

- Interesting & Engaging.

- Practical with real life examples.

- Clear and easy to understand.

- Challenges you to think, explore, and discover new ideas.

All assignments are checked by our instructors and provide feedback on your assignment to help you improve and learn more effectively

All-encompassing e-book

Imagine you’re going on an exciting adventure, like exploring a new land. But to make the most of your adventure, you need a map that shows you all the important places to visit and how to get there!

- Covers all the essential topics related to investing.

- Practical advice that readers can apply in real-world investing.

- Filled with with examples and case studies.

- Easy to read & understand

It’s like having a friend that you can always go to for help and guidance.

Investing is one of the best ways

to become financial independent

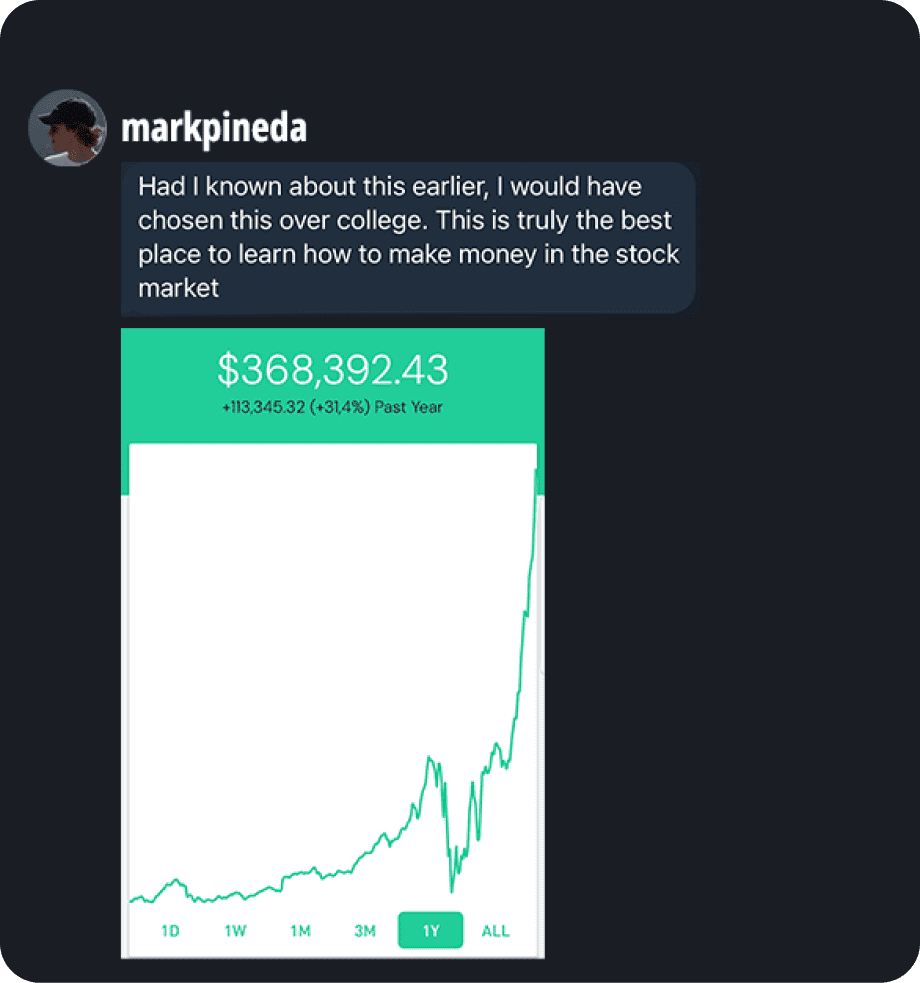

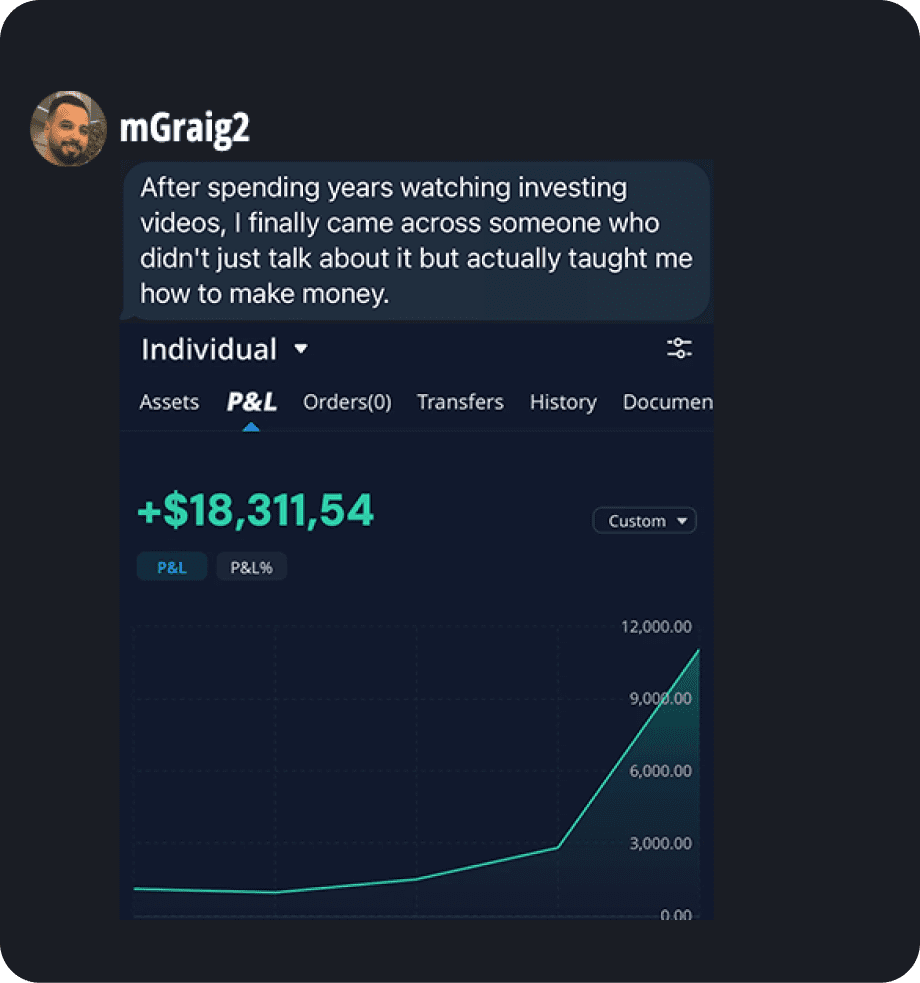

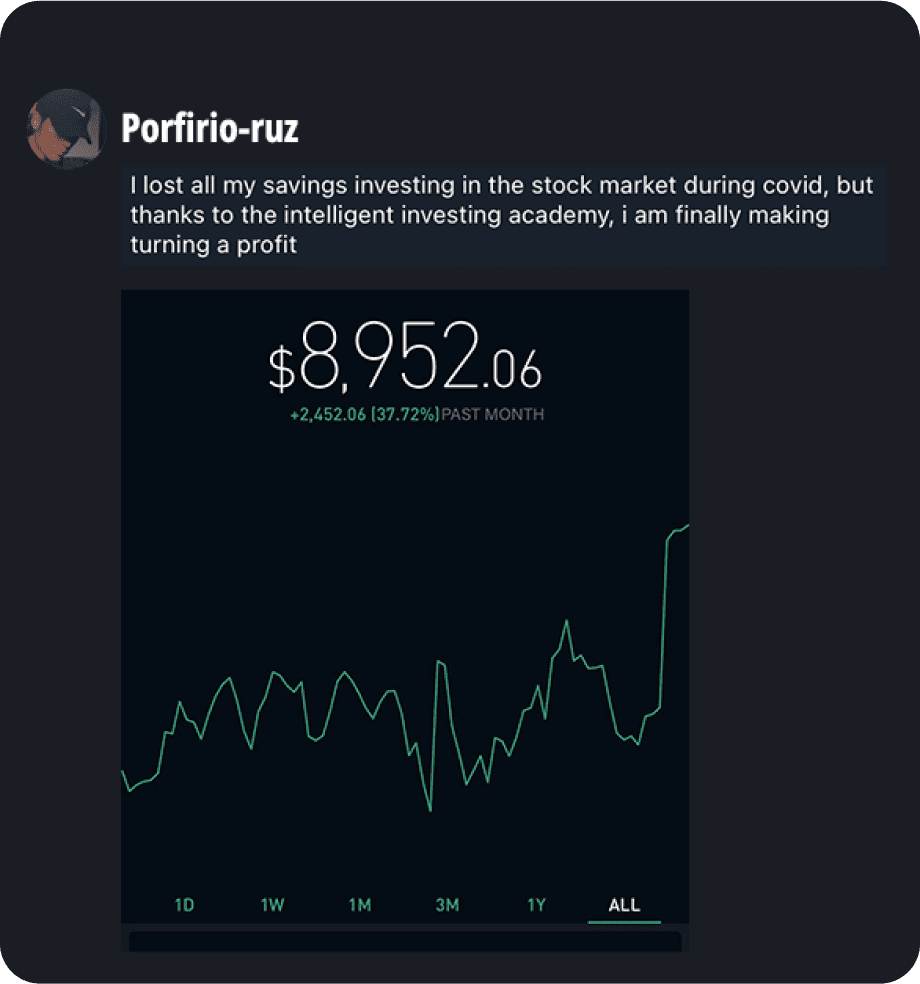

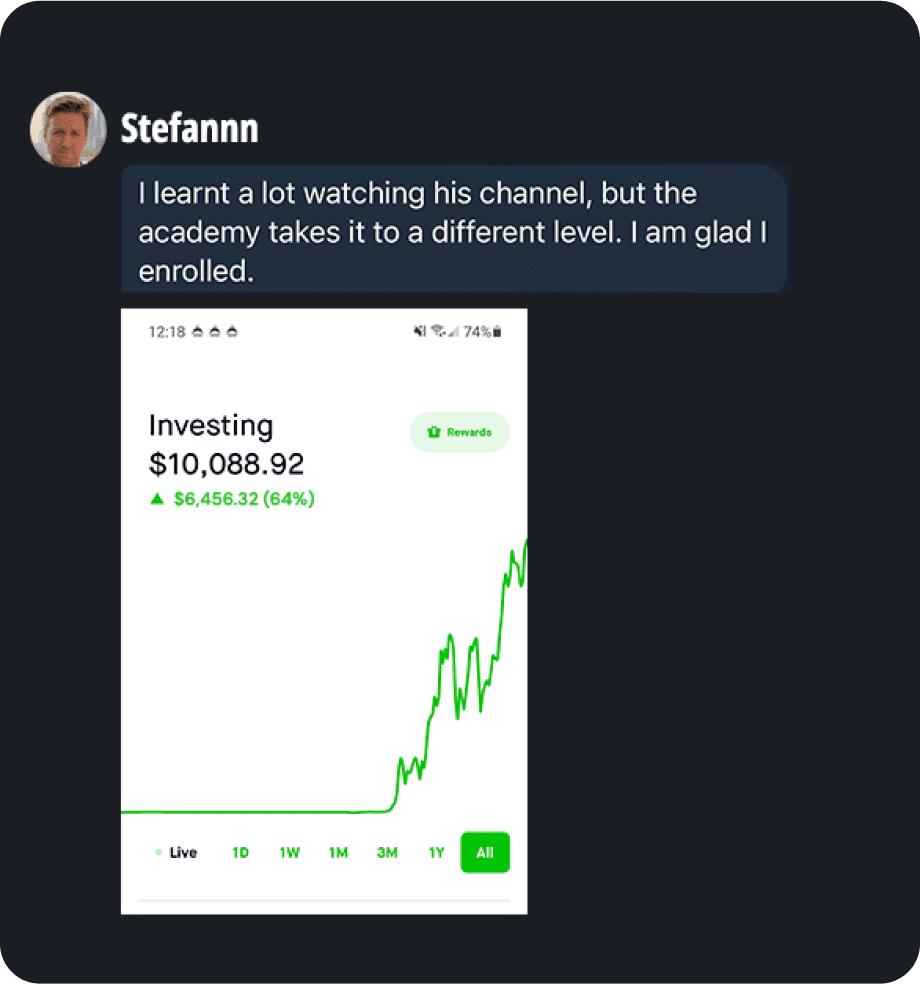

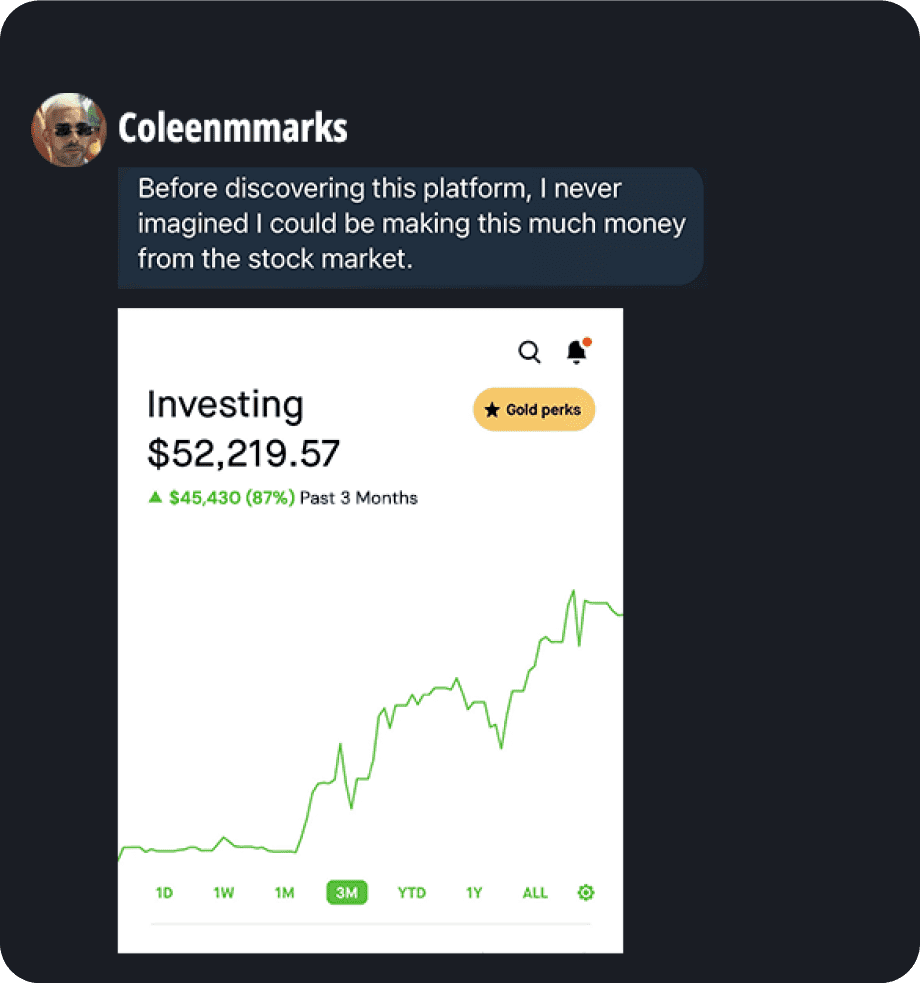

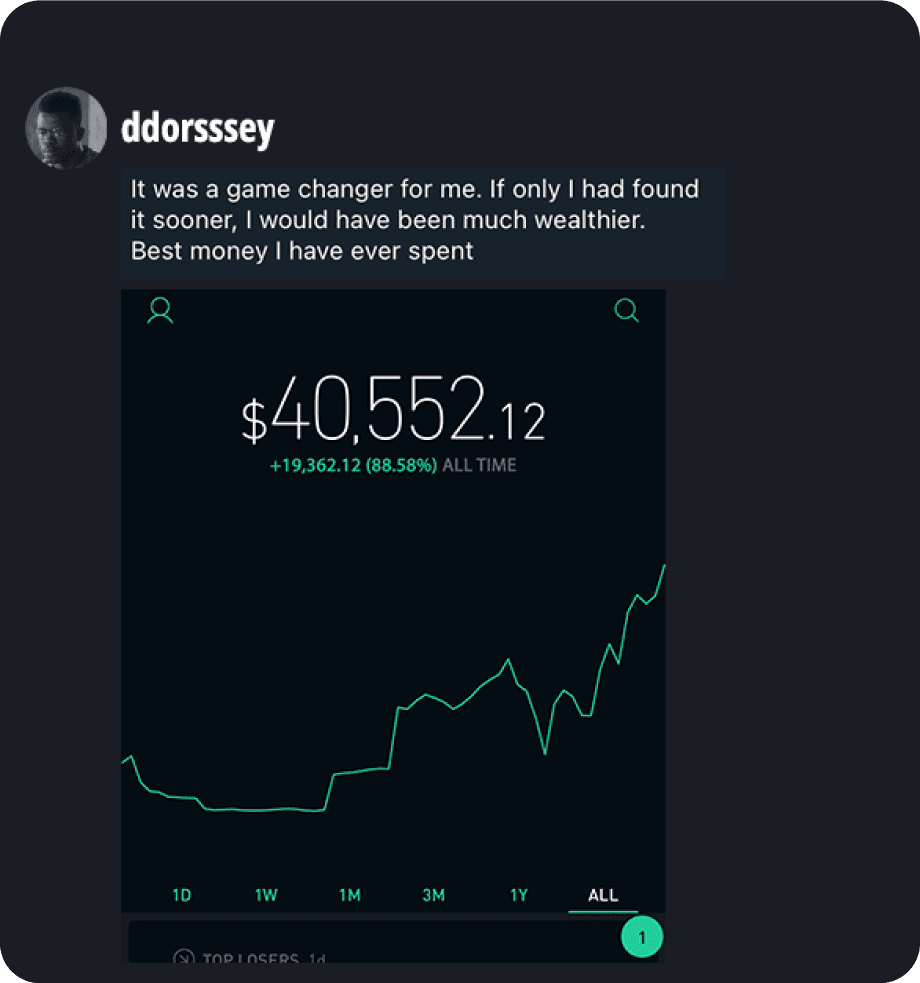

We are proud of our students

ESCAPE THE RAT RACE

While you wondering if you should start investing, Wall Street is making the kind of money that you can’t even imagine. When you are broke, you feel like everyone around you is also broke.

However, there is $50 trillion just in the US stock market and $110 trillion worldwide. Making a lot of money is possible if you know where to look.

Join only if you are ready to put in the work

and become financially independent.

join 3,536 like minded people

FAQ

Absolutely! Investing is a skill that can be learned!

No, but we encourage you to consult your parents or a guardian before signing up if you are under 18.

Not at all! Our program is designed both for beginners as well as for people with prior knowledge about the stock market.

This program is for anyone interested in learning about investing.

You will get lifetime access to the program even when the price goes up.

The content of this program is intended to be educational and informative. It does not constitute financial advice, and we do not make any guarantees or promises regarding investment outcomes. The program doesn’t guarantee any profits or financial success.

All Rights Reserved